Rating is sourced fromTrustPilot and current clients of Domain Money Advisors, LLC. No compensation was provided in exchange for testimonials.

Keep more of what’s yours

Your Domain CFP® professional builds a forward-looking tax strategy that supports your entire financial plan, from how you manage equity compensation and investments to when you give, contribute, or withdraw.

We anticipate potential tax implications before they happen, using quarterly planning, scenario analysis, and “what-if” modeling to keep you prepared. It’s all about making smart decisions today that can help maximize your tax savings for years to come.

How tax planning can help you

Tax planning isn’t one-size-fits-all—it looks different depending on your life stage, goals, and sources of income. Here’s how our advisors tailor strategies for you based on who you are and what matters to you:

Tax filing expertise tailored to you

Whether you earn W-2 income, own real estate, receive RSUs, or run a business, you’re matched with a licensed professional who gets it right.

Every tax decision optimized

Your advisor helps ensure each financial decision—like child education savings or retirement contributions—supports your broader tax strategy.

Keep more of what you earn

Reduce taxes and build after-tax wealth with strategies like charitable giving, Roth conversions, and equity planning.

Smarter year-round tax planning

Tax planning isn’t just for April. Your strategy evolves with your life—so you stay ahead of changes, not behind them.

The Domain Money difference

With us, you don’t just get a plan—you get a partner.

For Illustrative Purposes Only

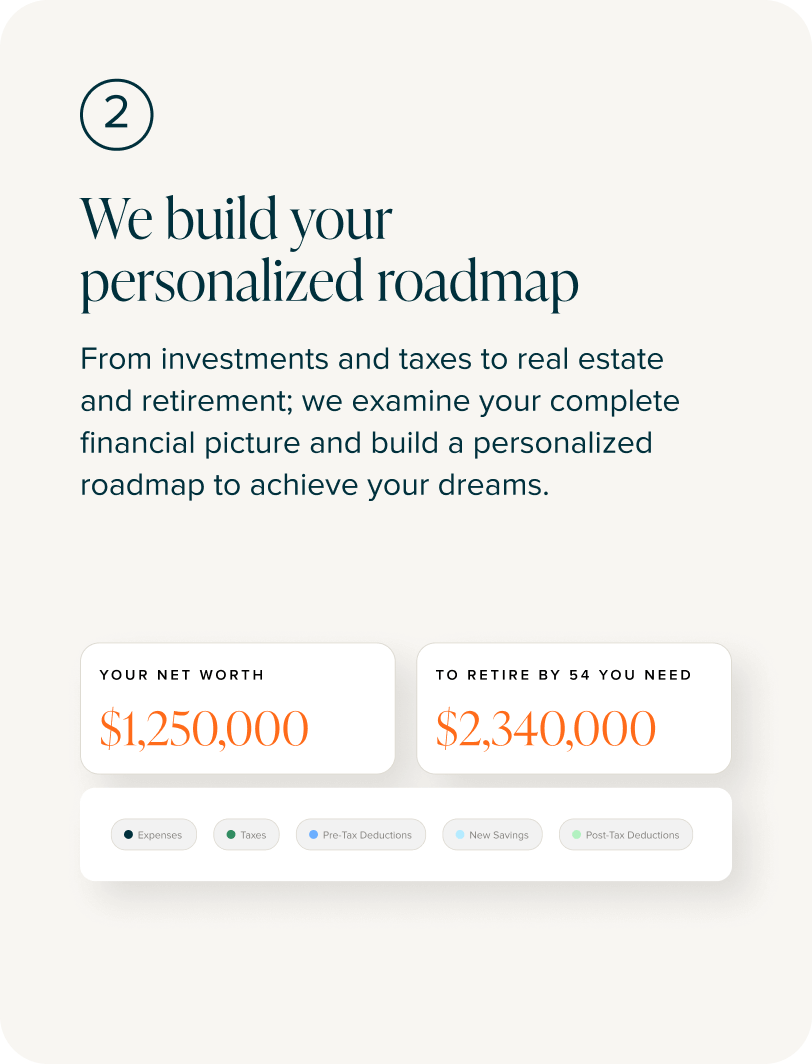

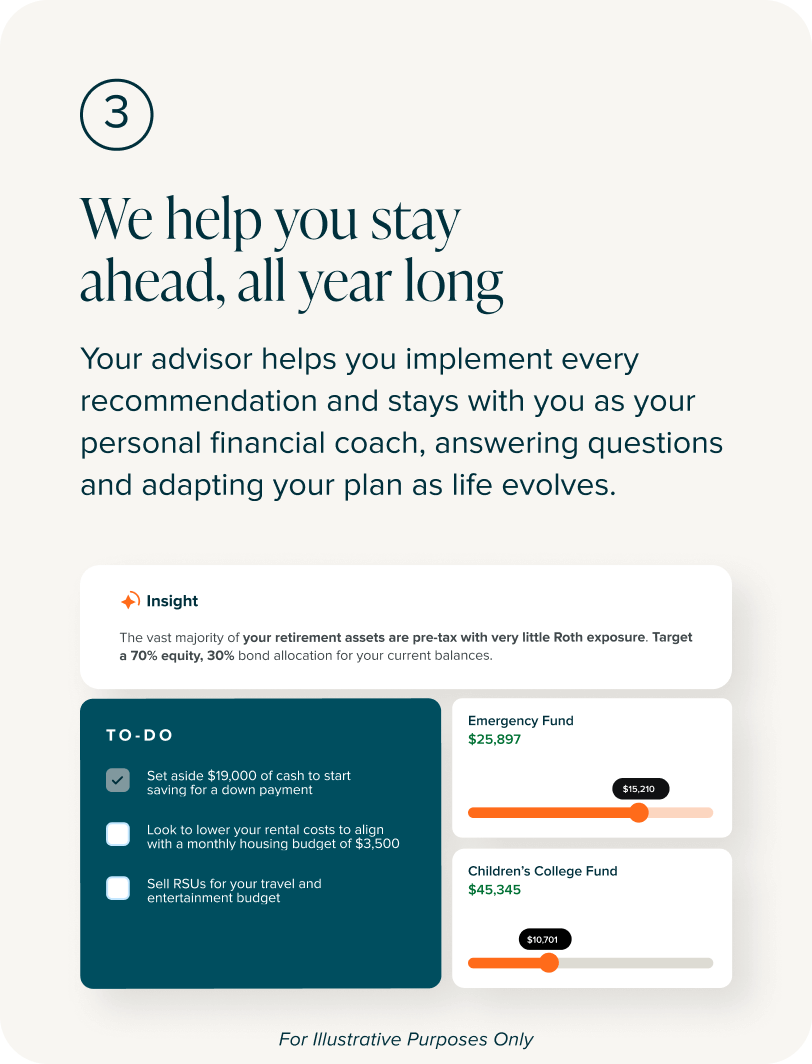

Explore our process

At Domain Money, tax filing is handled by our expert partner professionals to ensure your return is accurate and complete. Tax planning goes further—it’s a year-round, proactive approach where your CFP® professional anticipates potential liabilities, aligns tax strategies with your financial goals, and helps you make smart, informed moves throughout the year.

Anyone can benefit, but it’s especially valuable for Domain clients with equity compensation, business owners, if your compensation fluctuates, families managing education or mortgage expenses, and retirees planning withdrawals. Our advisors tailor strategies to each situation, helping you reduce your tax burden while keeping your broader financial goals on track.

Domain’s CFP® professionals don’t wait for April. We check in quarterly, run scenario modeling, and explore “what-if” options so you can anticipate changes before they affect your finances. This proactive approach helps you avoid surprises, optimize your tax moves, and stay confident in your financial decisions all year long.

Yes. We’ve partnered with Taxfyle to make tax prep seamless. You’ll be matched with a licensed tax professional (CPA or EA) who will handle your federal, state, and complex filings. Behind the scenes, your Domain CFP® professional ensures your taxes are fully integrated into your overall financial plan—so everything works together to support your bigger goals.

*Taxfyle is not affiliated with Domain Money Advisors LLC. Taxfyle has a partnership with Domain Money Advisors LLC in an effort to provide clients with tax filing services.

We focus on strategies that reduce your tax burden both now and in the future—coordinated with your broader financial goals. These may include:

- Tax-loss harvesting to offset capital gains and reduce taxable income

- Optimizing equity compensation (RSUs, ISOs, NSOs) to avoid unnecessary tax hits

- Asset location planning to prioritize tax-efficient investments in taxable vs. tax-advantaged accounts

- Charitable giving strategies like donor-advised funds or qualified charitable distributions (QCDs)

- Roth conversions and contribution planning to manage long-term tax exposure

- Estimated tax guidance for self-employed professionals or clients with variable income

- Tax-smart withdrawal strategies to help minimize taxes in retirement

- Maximizing deductions and tax credits including identifying any missed on prior year's tax returns

You’ll be matched with a licensed Certified Public Accountant (CPA) or Enrolled Agent (EA) who will prepare and file your federal and state returns. Behind the scenes, your dedicated Domain CFP® professional works to ensure your tax strategy is aligned with your broader financial plan—so every deduction, credit, and decision fits into your long-term goals.

We handle everything from standard filings to more complex returns, including multi-state income, K-1s, investment income, rental properties, and more. Need to report foreign accounts or crypto? We’ve got that covered too—your tax pro will flag any specialty forms needed and ensure full compliance

After a quick intake questionnaire, you'll securely upload your documents through a private portal. From there, you’ll be matched with a licensed tax professional who will handle the preparation and filing. If any additional details are needed, a dedicated client services rep will guide you through next steps. Throughout the process, your Domain CFP® professional ensures your tax filing stays aligned with your overall financial strategy. Turnaround times vary based on complexity, but most clients are fully filed within a few weeks.

Most CPAs or tax software focus only on filing your return. At Domain, tax filing is integrated with your financial plan—so you’re not just reporting what happened last year. You're making proactive decisions that support your long-term goals, reduce future tax liabilities, and align with how you save, invest, and spend.

Yes. As part of our onboarding process, we review your prior year’s tax return to help identify any major red flags—like missed deductions, credits, or filing issues—that could impact your current strategy. This helps ensure we start with a clear picture and don’t overlook opportunities going forward.

Yes. If you’re self-employed, have variable income, or expect a major financial event, your Domain advisor can help you plan ahead with quarterly estimated tax payments and cash flow strategy—so you avoid surprises and stay on track with your broader plan.

Taxfyle is not affiliated with Domain Money Advisors LLC. Taxfyle has a partnership with Domain Money Advisors LLC in an effort to provide clients with tax filing services.