Rating is sourced from TrustPilot and current clients of Domain Money Advisors, LLC. No compensation was provided in exchange for testimonials.

It’s never too early to start planning

Whether you’re in your 30s building a strong foundation, in your 40s balancing competing goals, or in your 50s fine-tuning your strategy, the right plan helps you stay on track today while building the lifestyle you want for tomorrow.

Nearly 60% of Americans say they’re behind on retirement savings1. But having a plan can increase the chances you reach your goals by nearly 4X2.

That’s why a personalized, step-by-step plan can make all the difference. With Domain Money, your plan gives you:

1) Based on the 2025 Bankrate Retirement Savings Survey. 2) Based on 2023 T. Rowe Price Retirement Savings and Spending Study that showed individuals with a formal plan were over two to almost four times wealthier than pre-retirees without a plan.

Financial freedom, defined by you

Retirement isn’t a finish line—it’s a stage of life you design.

For some, it’s traveling the world or finally taking on dream projects. For others, it’s supporting family, giving back to causes, or simply enjoying more time with the people you love. Many just want the flexibility to slow down and savor everyday life without financial worry.

At Domain Money, we help you build lasting security so your money supports the life you choose, at every stage.

How Domain Money helps

Your dedicated CFP® professional works with you to:

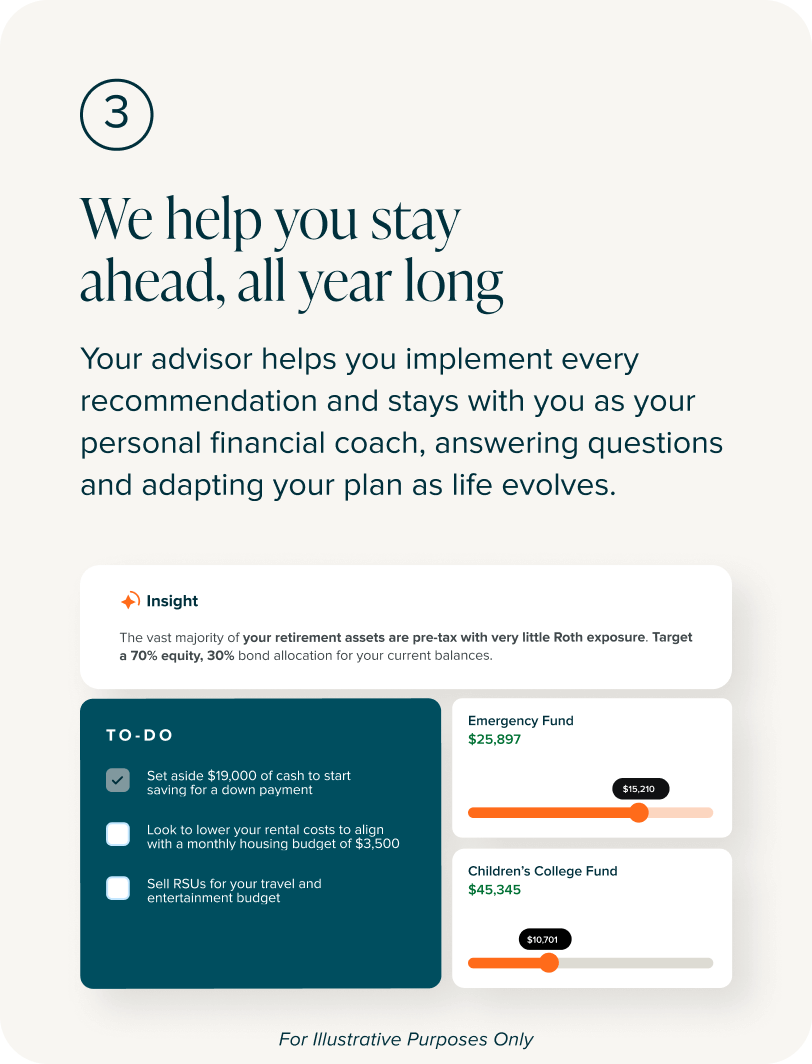

Clear action items

From 401(k) contributions to Roth strategies, you’ll know exactly what action to take.

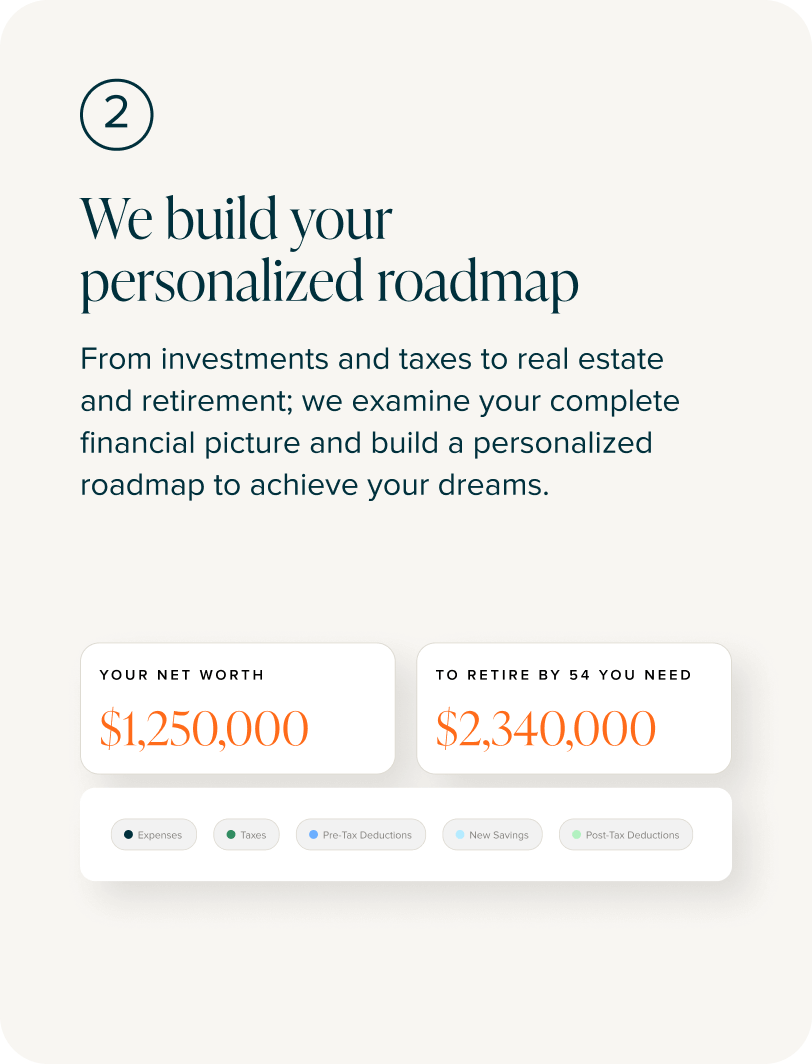

Measure progress

See where you stand and what’s needed to close the gap.

Adapt over time

Your plan isn’t static. We update it as your income, family, and goals change.

Unlike many firms, we charge a flat, transparent fee. No AUM fees, no commissions, no product sales—just unbiased advice in your best interest

Ready to retire on your terms?

Plan your future with confidence. See how much you might need to save and explore personalized strategies with a free strategy session.

If you retire at 0 you can live off your wealth until you are 0

This plan focuses on achieving an early retirement, which sounds fantastic! But based on your current inputs, it might not provide enough funds to cover your living expenses for your entire retirement. Remember, retirement can be a marathon, not a sprint, and you want your savings to keep pace.

Let's chat and see if we can tweak your strategy for a longer runway.

Consider a free strategy session with a Domain advisor!

You've chosen a balanced approach, which is a smart start for retirement planning! Based on your current inputs, your plan offers a solid runway. However, retirement can last 20+ years, and unforeseen events can impact your expenses.

Let's chat and see if we can tweak your strategy to stretch those funds even further and ensure a secure, worry-free retirement.

Consider a free strategy session with a Domain advisor!

Excellent! This plan prioritizes security and could see you comfortably through your golden years.

Feeling confident? Great! If you ever have questions or want to explore ways to potentially boost your returns, we're always here to chat.

The Domain Money difference

With us, you don’t just get a plan—you get a partner.

For Illustrative Purposes Only

Explore our process

The earlier, the better. Starting in your 20s or 30s allows you to take advantage of compounding growth. But even if you’re closer to retirement, creating a plan now can still make a meaningful difference in reaching your goals.

There’s no one-size-fits-all number—it depends on your lifestyle, expenses, and retirement goals. A common guideline suggests saving 10–15% of your income during your working years, but calculating your target amount based on your unique needs is key.

Some of the most common missteps include starting too late, underestimating future expenses, relying only on Social Security, and not adjusting plans as life changes. Regularly reviewing and updating your strategy helps you stay on track.

Most people start with tax-advantaged accounts like a 401(k), Traditional IRA, or Roth IRA. These accounts let your money grow with special tax benefits, and some—like a 401(k)—may include an employer match that boosts your savings. High earners may also consider HSAs (if eligible) or taxable brokerage accounts once they’ve maxed out other options. The right mix depends on your income, goals, and whether you value tax breaks now or in retirement.

A simple rule of thumb is to aim for 10–15% of your income saved each year and a total nest egg equal to about 25x your annual spending by the time you retire. But everyone’s path looks different. The best way to know is to create a personalized plan that projects your income, savings rate, and lifestyle goals against future expenses. Tools like a retirement calculator or a CFP® professional can help you see if you’re ahead, behind, or right where you need to be.

*This material has been prepared for informational and educational purposes only. It is not intended to provide, and should not be relied on for, investment, tax, legal, or accounting advice. Please consult your own financial advisor or tax professional before making any decisions. Domain Money, LLC is a registered investment adviser. Registration does not imply a certain level of skill or training.