Investment Management

Investment management, without a 1% fee on your wealth

Professional investment management integrated with your financial plan.

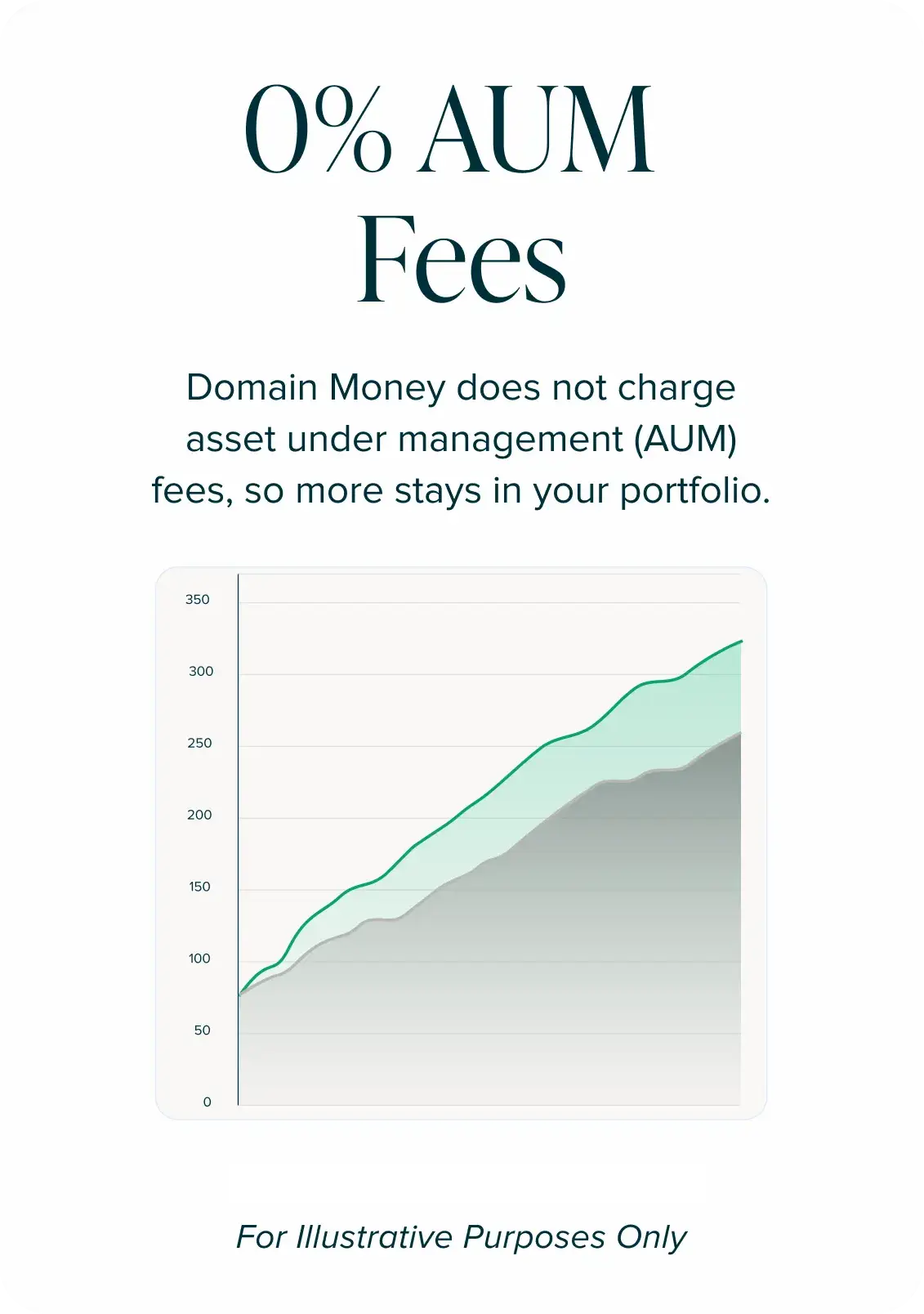

0% AUM (assets under management) fees.

Rating is sourced from TrustPilot and current clients of Domain Money Advisors, LLC. No compensation was provided in exchange for testimonials.

Investment management from Domain Money

Goal-based investing that is tax-aware to help you reach your goals faster.

Custody & Security: Accounts are held at Altruist Financial LLC (Member SIPC), protecting securities up to $500,000 ($250,000 cash). Altruist maintains an excess policy through Lloyd’s of London with a $40 million per account limit ($2 million cash sub-limit), subject to a $150 million firm-wide aggregate. Cash in the Bank Sweep Program is swept to partner banks for FDIC insurance eligibility up to $250,000 per depositor, per bank (details at fdic.gov). Data is protected via AES-256 encryption and validated by SOC 2 Type 2 audits. Go here for more information.

Financial planning and investment management, integrated and aligned

Your goals, cash, and investments working together—designed to help minimize taxes and improve returns.

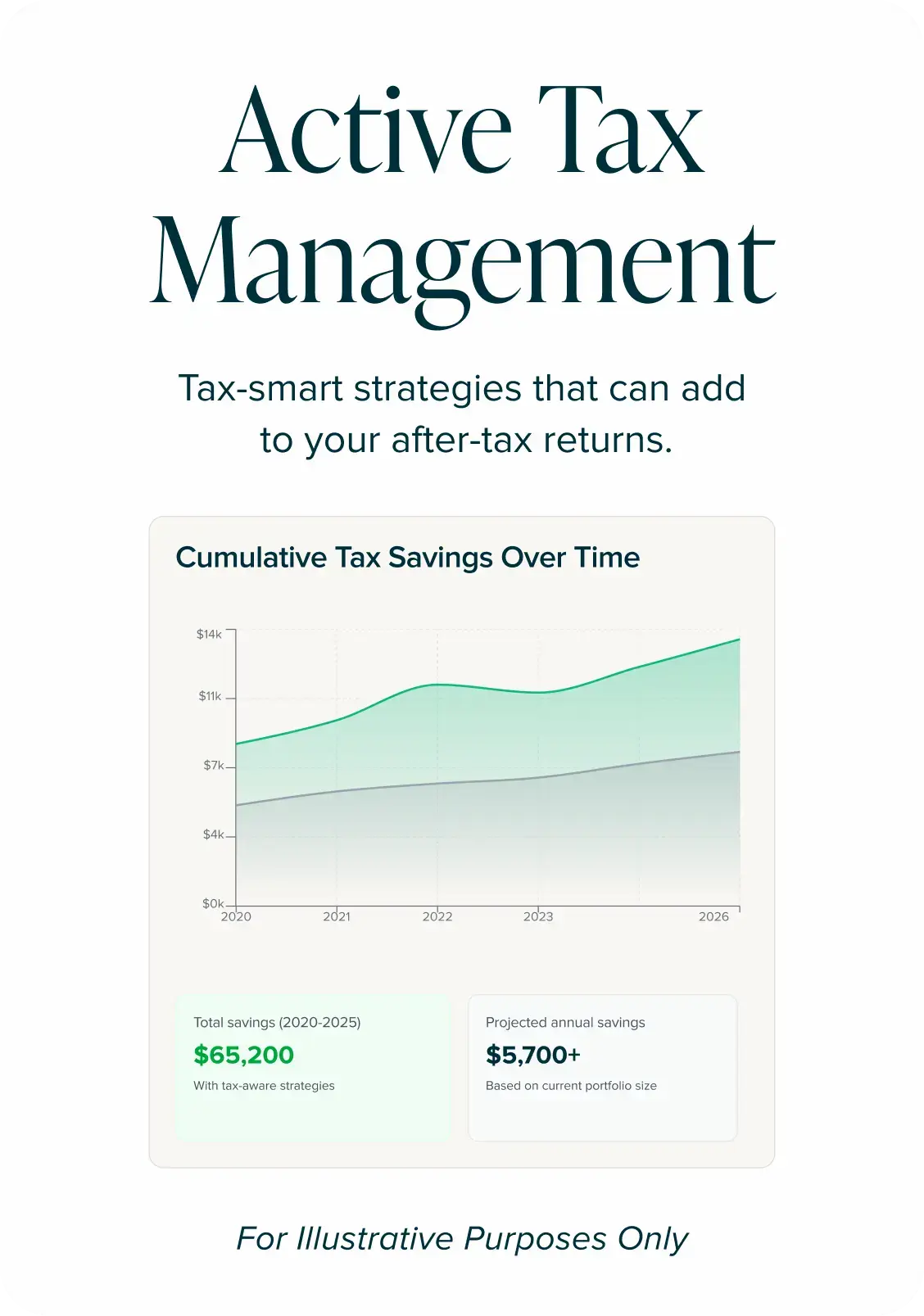

Tax-smart

investing

Tax-loss harvesting and smart asset allocation to help reduce taxes over time.

Integrated planning

and investing

Portfolios built around your goals, risk tolerance, and timeline - all aligned with your financial plan.

Ongoing portfolio

management

Active rebalancing as markets shift or as there are changes in your life.

Direct

indexing

Own the stocks, not the fund. A strategy designed to unlock tax benefits that standard ETFs miss.

High-yield cash

management

Earn high interest rates, 3.20%* APY in our cash management account.

Fiduciary

standard

We are legally bound to act in your best interest, putting your financial well-being ahead of our own.

For Illustrative Purposes Only

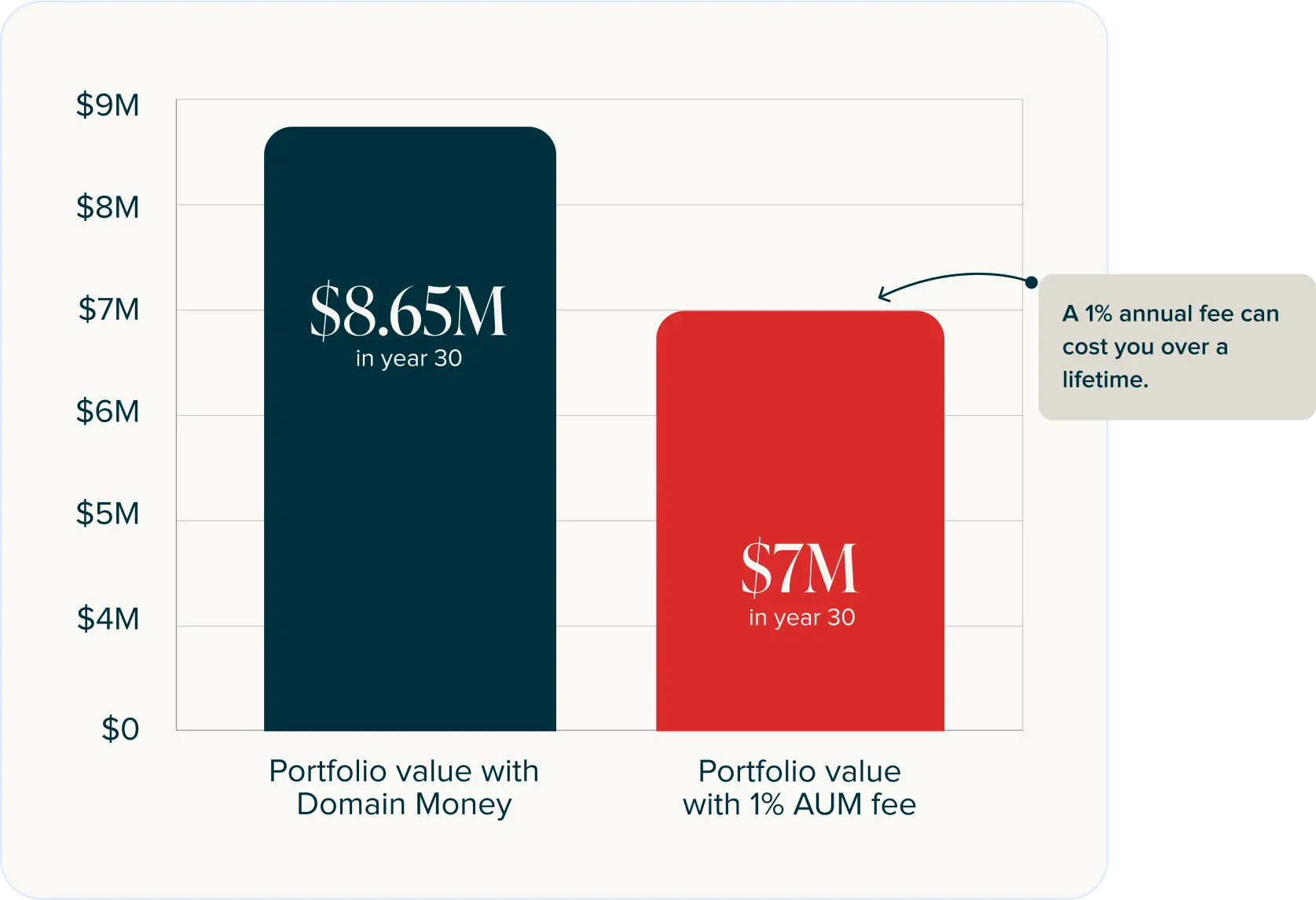

What 1% AUM fees cost you over time

1% fees on your assets meaningfully impact returns over time.

Domain Money does not charge asset under management (AUM) fees, so more of your assets can compound.

Assumes $500,000 starting portfolio, $50,000 annual contributions, and a 7% annualized return over 30 years. This calculation assumes no underlining additional fees. For illustrative purposes only.

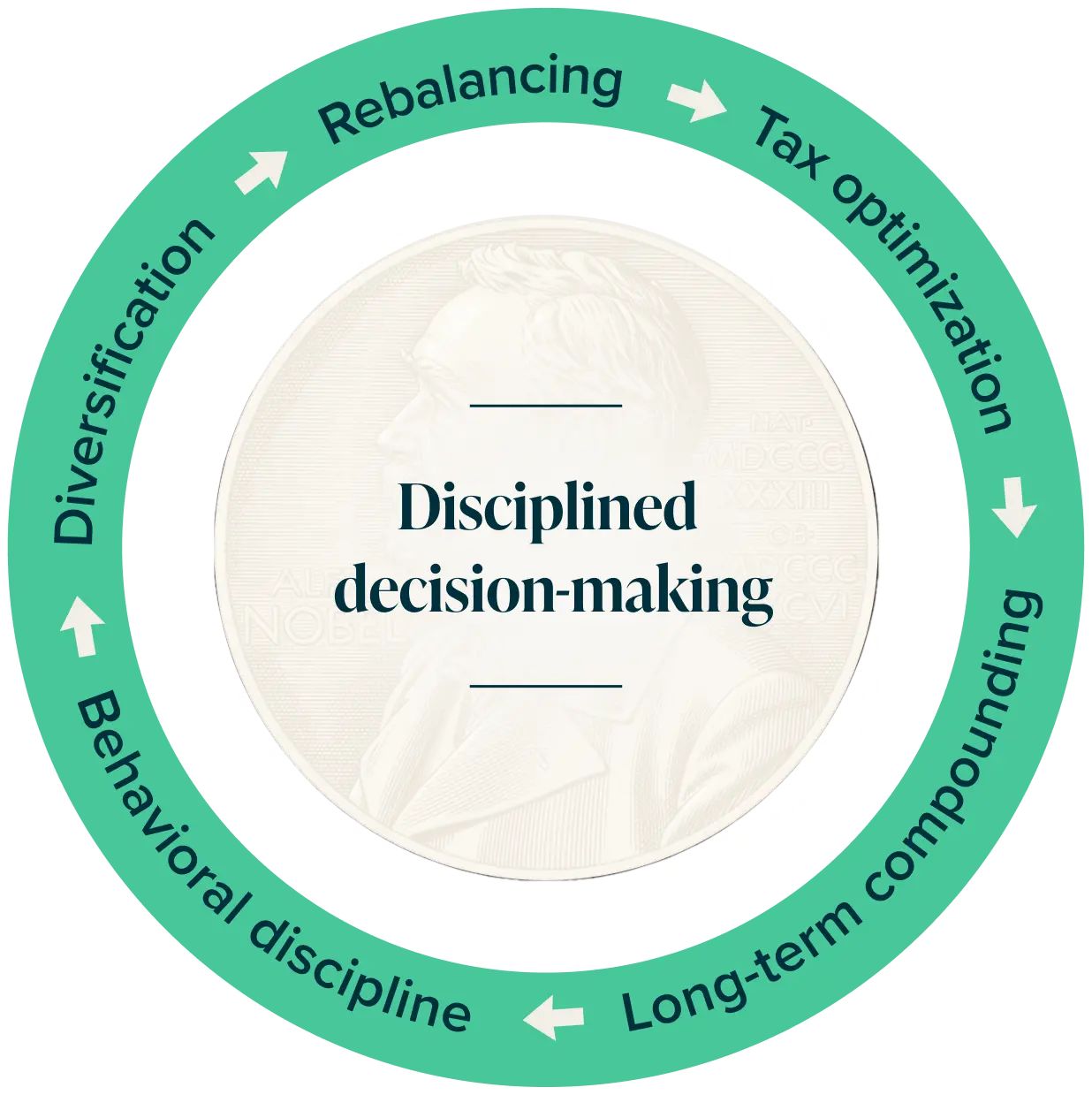

Proven strategies, not trends

Domain Money’s investment philosophy is based on decades of research, utilizing Nobel Prize-winning principles of disciplined diversification, systematic rebalancing, and proactive tax management.

Domain Money applies these principles to every portfolio, matching the needs of our clients with the right investment approach.

Security and Trust

Excess SIPC Coverage

Standard SIPC coverage protects up to $500,000 per account. Domain Money offers an additional $40 million per account through Lloyd's of London.

FDIC Insurance

Cash held in FDIC-insured partner banks and protection against insolvency.

Advanced Encryption

Bank-level encryption (AES-256 standard) and Multi-Factor Authentication protects your personal and financial data.

See the Domain Money Difference

Typical AUM Advisor | Robo-Advisor | ||||

|---|---|---|---|---|---|

Advisory Fee | 0% | ~1% | ~.25% | ||

Tax-Loss Harvesting | Daily monitoring | Limited | |||

Direct Indexing | Typically only for premium tiers | ||||

Dedicated CFP® Professional | Paid on AUM | No human | |||

Integrated Financial Planning | Usually separate fee | Investments only | |||

Fiduciary Duty | Always |

The bottom line: Many advisors charge a 1% fee on your assets annually. Domain Money charges a flat annual fee, so you keep more of your wealth over time.

According to the 2024 Kitches Report, most traditional financial advisors charge around 1% of your assets under management (AUM) each year as a fee, regardless of performance.

Investment management that fits your life

Professional management. Better outcomes.

Domain Money manages your investments so you don't have to. Get expert advice and tax-smart strategies that aim to maximize your wealth.

Frequently Asked Questions (FAQs)

- CFP® Professional Oversight: We build, implement, and monitor your personalized investment portfolio that’s guided by your short and long-term goals, risk tolerance, and other priorities.

- Automated Rebalancing: We systematically adjust your portfolio to maintain your target asset allocation.

- Advanced Tax Optimization: In taxable accounts, we implement Tax-Loss Harvesting (TLH) and active tax management to help minimize your tax liability and generate "tax alpha".

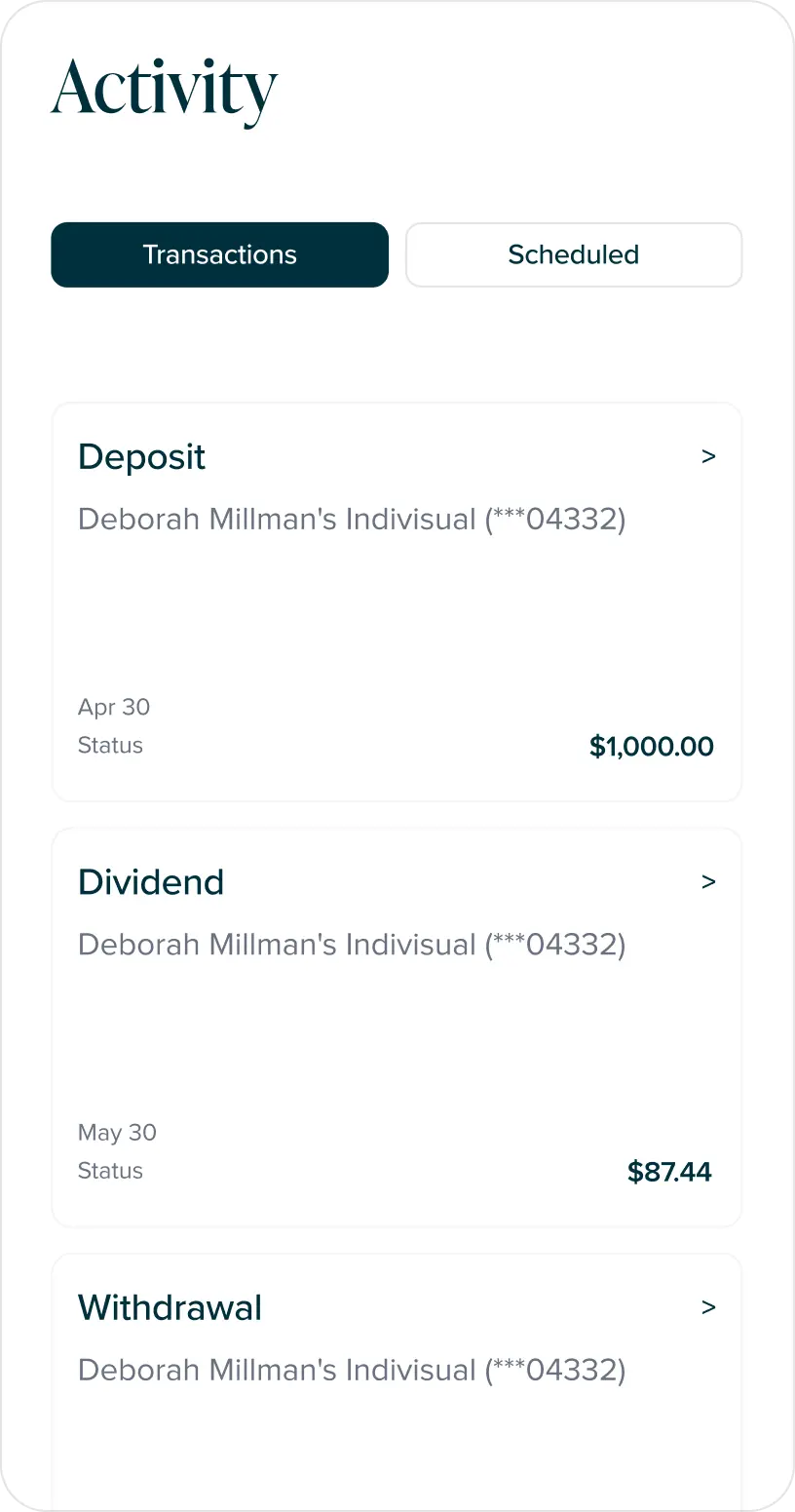

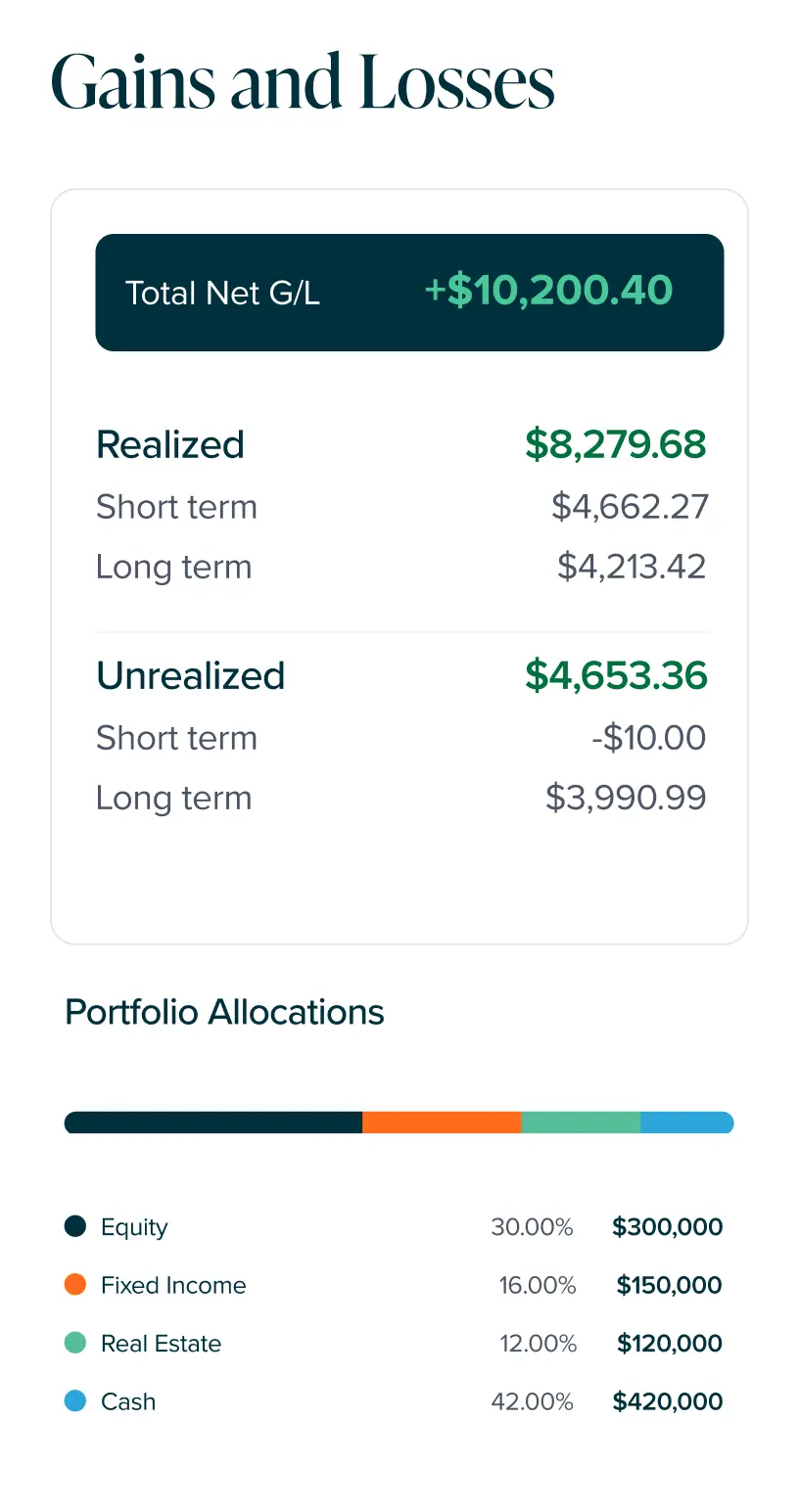

- Performance Tracking: Access to a modern dashboard and regular reports to monitor your progress in real-time.

- Stocks and Exchange-Traded Funds (ETFs): Diversified, low-cost model portfolios and individual equities tailored to your specific risk tolerance.

- Mutual Funds and Fixed Income: A wide selection of over 12,500 mutual funds, bonds, and other fixed-income securities.

- Direct Indexing: For qualifying accounts, we offer direct indexing to allow for granular tax-loss harvesting and personalized security exclusions.

- High-Yield Cash: Access to high-yield cash accounts with FDIC insurance.

Domain Money charges zero AUM fees. Investment management is included in our flat-fee memberships, plus $0 trading for all members.

- Direct indexing may include a 0.12% (12 bps) fee charged by Altruist

- ETFs and mutual funds carry internal expense ratios set by the fund provider

Accounts are titled in your name, and Altruist is responsible for custody, record-keeping, and transaction processing. Domain Money provides investment oversight and advice.

Eligible brokerage accounts are protected by SIPC insurance up to $500,000 per client (including up to $250,000 for cash) in the event of broker-dealer insolvency. In addition to the standard $500,000 protection, Altruist cover another $40 million per account through Lloyd's of London (with aggregate limit of $150 million across all accounts).

- Our internal investment committee, which sets portfolio frameworks and risk guidelines, and

- A dedicated trade operations team, which is responsible for implementing trades and rebalancing in client accounts.

- View balances and holdings

- Track performance

- Initiate deposits or withdrawals

- Access statements and tax documents

*3.20% APY for the Altruist Cash accounts (‘Altruist Cash’), as of February 2026. The Annual Percentage Yield (‘APY’) is variable and may change at any time. The amount of interest you will receive on your deposits will vary based on a number of factors. Accrued interest is paid on the last business day of the month directly into the Altruist Cash account. For addition information please visit Altruist and its disclaimers. APY Interest rate is impacted by the federal funds rate and is adjusted in line with changes made by the Federal Reserve. Regarding the 8x comment, the national average interest rate for savings accounts is 0.39% as posted on FDIC.gov, as of January 30, 2026.

Domain Money uses the services of TAMPs to manage your assets. While often no additional fees are charged by the TAMPs, on occasion for some strategies, an asset-based fee is charged directly by the TAMPs. Domain Money does not receive any portion of the fee charged by the TAMPs. You will be notified before Domain Money recommends investment in a TAMP strategy where this fee may be charged.