IUL vs. 401(k): Which is Right for Your Retirement?

An Indexed Universal Life (IUL) policy and a 401(k) plan are both ways to save for the future, but they work very differently. A 401(k) is an employer-sponsored retirement account with tax advantages, while an IUL is a permanent life insurance policy that can build cash value tied to a market index.

Getting a clear picture of how each option fits your unique goals and risk comfort can make choosing easier. At Domain Money, we act as fiduciaries—meaning we don’t sell life insurance or investment products. Our advice is based solely on what’s in your best interest.

Indexed Universal Life Insurance Policies

If you’re looking for a way to help protect your family while also building cash value that grows with the market, an Indexed Universal Life insurance policy could be worth a closer look. It blends life insurance with investment-like growth in a flexible package.

What It Is

An Indexed Universal Life insurance policy is more than just life insurance. It offers lifelong protection while letting your cash value grow with the stock market. It’s a way to combine security with growth potential.

How Cash Value Grows

In the early years, a larger portion of your premium typically goes toward insurance costs and fees, so cash value can build more slowly. Over time, as your cash value builds, compound growth can kick in. The growth is based on a crediting method tied to market gains, but with a floor to protect you.

For example, if your cash value is $50,000 and the index gains 15% with a 10% cap, you can earn $5,000. If the market drops 20% the next year, your cash value doesn’t lose ground because of a 0% floor. This balance can help manage risk while giving your money room to grow.

How the Death Benefit Works

The death benefit is a financial safety net for your loved ones. Unlike retirement accounts, the IUL provides a death benefit regardless of market conditions, as long as required premiums are maintained. Plus, this benefit generally passes to beneficiaries income tax-free, offering immediate support when it’s needed most. Any outstanding loans or unpaid interest will reduce the death benefit your beneficiaries receive.

401(k) Plans

A 401(k) is a straightforward, employer-sponsored way to save for retirement that comes with tax advantages and often employer contributions. It’s designed to help you grow your savings steadily and reduce your tax bill along the way.

What It Is

This plan is a popular, employer-sponsored retirement savings vehicle that helps you save more efficiently with tax benefits and sometimes employer contributions. It’s a simple, effective way to grow your retirement fund while lowering your current tax bill.

How Pre-Tax Contributions Work

When you contribute to a traditional 401(k), you're using pre-tax dollars.

For instance, if you make $80,000 and contribute 10%, that $8,000 reduces your taxable income to $72,000—meaning you pay less tax today while saving for tomorrow.

For 2026, you can contribute up to $24,500 if you’re under 50. If you’re 50 to 59, you can contribute an extra $8,000 catch up. And if you’re 60-63, the catch up amount increases to $11,250.

Employer Matching

Many employers boost your savings by matching contributions.

For example, a common match is dollar-for-dollar up to 6% of your salary. If you earn $60,000 and max out that 6%, that’s $3,600 in free money added to your retirement fund each year.

Keep in mind vesting schedules, which determine when employer contributions become fully yours. Some vest immediately, others over time.

Cash Value Growth

When you compare how cash grows in an IUL versus a 401(k), the differences stand out.

A 401(k) gives you direct exposure to the market—your account value rises and falls based on your investments.

An IUL provides a death benefit. It also has the potential to build cash value that tracks a market index without direct investment.

Tax Deferred Growth vs. Potential Tax-Free Access

With a 401(k), your money grows tax-deferred, meaning you don’t pay taxes on earnings until you withdraw them in retirement. Every dollar you take out is taxed as ordinary income.

An IUL works differently. You can potentially access your cash value tax-free through policy loans, giving you more flexible options to supplement retirement income without immediate tax hits. Note that, if a policy lapses while you have an outstanding loan, the borrowed amount may become taxable as income. This is why ongoing policy management is key—something savvy financial planners like those at Domain Money watch for when helping clients integrate an IUL into their plan.

Index Caps and Fees

Index caps set a ceiling on how much your IUL cash value can earn annually, often around 10-12%. That means even if the market gains more, your credited growth won’t exceed the cap.

Fees are another key factor: 401(k) costs typically include fund expense ratios and plan administration fees. IULs add insurance-related charges that can range from 2-3% per year early on. In addition to upfront and ongoing insurance charges, carriers can also adjust cap rates and other policy costs. Changes like these can affect your projected cash value growth, so it’s important to review your policy regularly.

Withdrawal Rules and Taxes

Knowing the withdrawal rules can save you from costly surprises. With a 401(k), taking money out before age 59½ usually means:

- A 10% early withdrawal penalty

- Plus ordinary income taxes on the amount withdrawn

After age 73, Required Minimum Distributions (RMDs) kick in, forcing you to withdraw a minimum amount each year, which can push you into a higher tax bracket.

In contrast, Indexed Universal Life (IUL) policies don’t have RMDs, giving you more control over when and how you access your money.

IUL Policy Loans

One of the biggest perks of an IUL is its policy loans. Here’s how they work:

- You borrow against your death benefit, using your cash value as collateral

- Interest rates typically range between 4% and 6% annually

- Meanwhile, your cash value continues to earn indexed credits

Watch the fine print on loan interest: With most IULs, you’ll pay interest on any policy loan. In some cases, that interest is credited back to your cash value (“wash” loans), but in others it’s paid to the insurance company as a cost—reducing the long-term benefit.

At Domain Money, our financial advisors specialize in helping you optimize 401(k) tax deferrals and IUL tax-free withdrawals, often comparing top providers like Fidelity and Nationwide to find the best fit.

The exact IUL structure depends on the policy, so it’s important to understand how yours works before borrowing. Variables impacting loans can include:

401(k) Early Withdrawal Penalties

Withdrawing from your 401(k) too early can get expensive quickly. For example, if you withdraw $30,000 at age 45 and you’re in the 24% tax bracket, you’d owe:

- $7,200 in federal income taxes (24% of $30,000)

- A $3,000 early withdrawal penalty (10% of $30,000)

That means $10,200 total in taxes and penalties, leaving you with just $19,800.

There are exceptions, such as the Rule of 55, which allows penalty-free withdrawals if you leave your job at age 55 or older. Knowing these rules upfront helps you avoid unexpected costs.

Pros and Cons

Every retirement plan involves some trade-offs, and choosing what fits your financial goals, lifestyle, and comfort level best. Here’s a deeper look at how 401(k)s and Indexed Universal Life (IUL) policies stack up in 2026.

401(k) Plans

Indexed Universal Life Insurance (IUL)

Our flat-fee financial planning gives you the flexibility to blend these strategies, combining the strengths of both IULs and 401(k)s to build a personalized retirement plan that works for your unique situation.

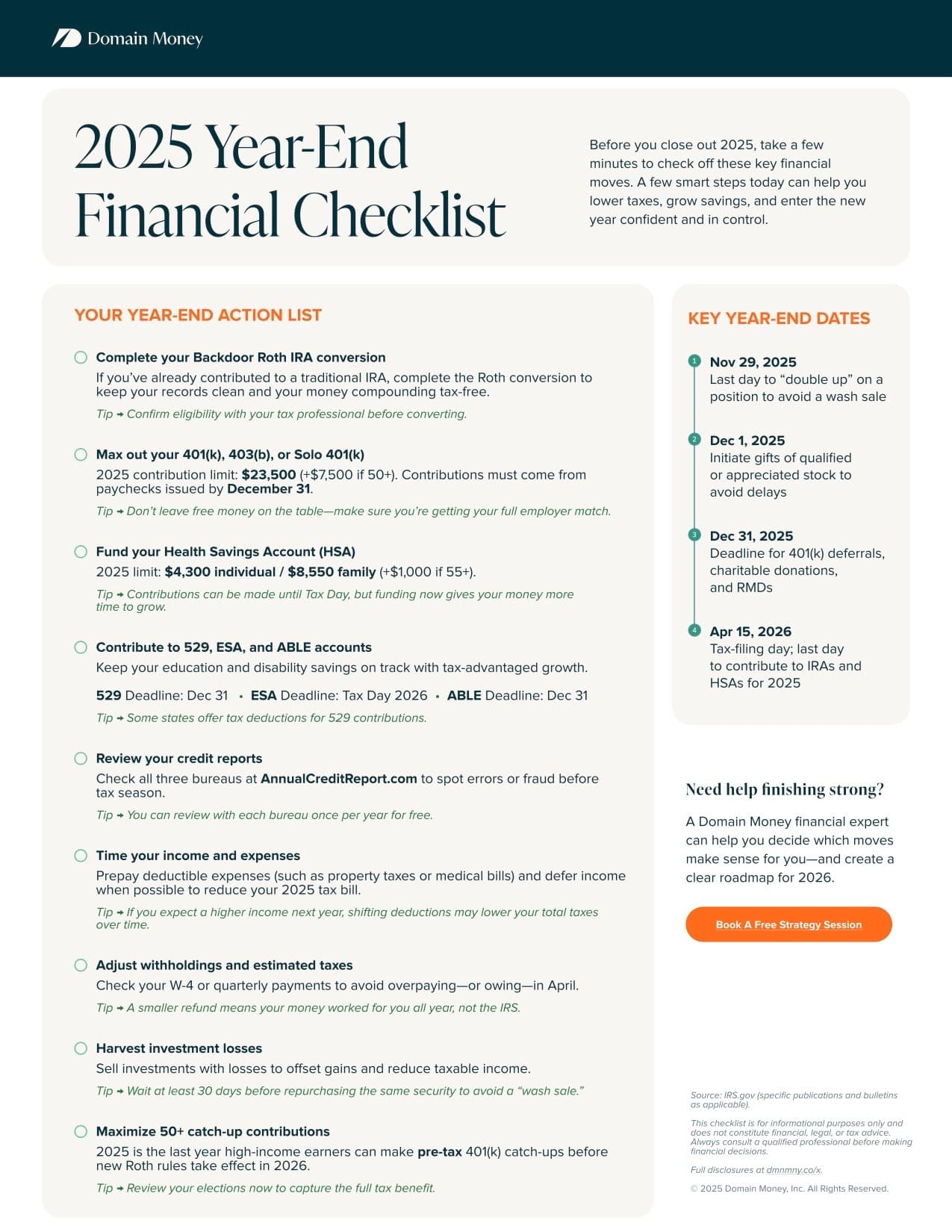

*Infographic* Policy loans often charge interest. In some policies, that interest is credited back to your account; in others, it is retained by the insurer. If the policy lapses, outstanding loans can create a large taxable event.

Choosing Your Retirement Strategy

Deciding between an IUL vs. 401(k) is going to depend on your goals, tax situation, and risk tolerance. Start by maxing out your employer match—that’s free money you don’t want to miss. Younger investors may favor the growth potential of a 401(k), while those closer to retirement might appreciate the downside protection and tax flexibility of an IUL. Remember, an IUL also offers a death benefit for added peace of mind.

Many find combining both tools works really well. This typically looks like using a 401(k) for savings and employer match, plus an IUL for tax diversification and life insurance. Your plan should evolve with your life, so review it regularly.rsification and life insurance. Your plan should evolve with your life, so review it regularly.

The key is to start now. At Domain Money, we provide expert, no-pressure guidance to help you build a personalized retirement plan that balances growth, protection, and taxes. Ready to take charge? Let’s get started.

Learn more from the IRS on 401(k) plans and FINRA on life insurance.

Frequently Asked Questions (FAQ)

Is an IUL account better than a 401(k)?

While both offer tax-deferred growth, max-funded IULs can sometimes provide greater flexibility in contributions and earlier access to accumulated cash value. This may involve potential tax implications and impact the death benefit. 401(k) contributions are limited, and withdrawals from a traditional 401(k) are taxed as ordinary income. Roth 401(k) withdrawals may be tax-free if certain requirements are met.

Can I have both an IUL and 401(k)?

Yes. Many people use both to diversify their retirement and protection strategy. A 401(k) offers tax-advantaged growth for retirement savings, while an IUL provides life insurance and potential cash value growth with downside protection. As fiduciaries, we help clients decide how to balance these based on goals, tax situation, and risk comfort.

Are IUL loans really tax-free?

Policy loans from an IUL can be structured to be income tax–free if the policy stays in force. However, if the policy lapses or is surrendered with a loan outstanding, the loan amount may be treated as taxable income. Managing the policy carefully is essential to avoid unexpected taxes.

What happens if I stop paying premiums on my IUL?

If you stop paying premiums, your IUL’s costs may be deducted from the cash value. Once the cash value is depleted, the policy will lapse, ending your coverage and potentially creating a taxable event if you have an outstanding loan. Some policies allow flexibility in premium payments, but this should be reviewed with a professional before making changes.

What are the disadvantages of IUL?

IULs can be complex and come with fees, including administrative costs, insurance charges, and caps on growth. These can impact how quickly your cash value grows. It’s important to fully understand the policy before committing.

How much do I need in a 401(k) to get $1,000 in income a month?

Roughly $240,000. That’s based on a 5% annual withdrawal rate, a common rule of thumb for sustainable retirement income.

Is an IUL good for retirement?

It can be, but usually only when paired with other strategies. An IUL offers tax-advantaged income and lifelong protection, but it works best as part of a diversified retirement plan. A mix of tools often leads to better balance and fewer tax surprises down the road.

This information is for educational purposes only and should not be considered personalized tax advice. Tax situations vary significantly based on individual circumstances. Consult with a qualified tax professional for advice specific to your situation. These are examples to illustrate how the tax bill impacts certain scenarios, and are not real clients of Domain Money. All tax information is sourced from https://www.congress.gov/bill/119th-congress/house-bill/1/text.

.jpeg)