Rating is sourced fromTrustPilot and current clients of Domain Money Advisors, LLC. No compensation was provided in exchange for testimonials.

Your money. Mastered.

Work with a dedicated CFP® professional who transforms your goals into a clear, step-by-step plan.

With ongoing guidance across every part of your financial life, you’ll have a personalized, integrated strategy that turns your goals into reality.

Get clarity with an interactive dashboard to see your progress- letting you get back to focusing on what matters most.

For Illustrative Purposes Only

Investments

Smart, diversified strategies that grow with you.

Taxes

Potentially cut your tax bill with proactive planning.

Retirement

Build freedom on your timeline.

Cash flow

Know where every dollar goes and why.

Real estate

Make property work for your goals.

More

Equity compensation, education savings, insurance, estate planning, and long-term care.

Membership that pays for itself

From smarter tax strategies to better investment decisions, get measurable results that justify the membership cost and then some.

3% higher investing returns

Working with the right financial expert can add up to 3% in net annual returns through better investment decisions, proactive tax planning, and behavioral coaching.1

Up to 4x more wealth

A clear, written financial plan can help you build 2–4x more wealth by retirement—because maximizing your potential starts with having the right plan.2

350+ hours saved

Trying to manage your finances alone is complex and time-consuming. Imagine what you could accomplish with an extra 350+ hours each year.3

Vanguard Research, "Putting a value on your value: Quantifying Vanguard Advisor's Alpha," which identifies approximately 3% in potential net returns through financial guidance, proper asset allocation, cost-effective implementation, rebalancing, behavioral coaching, and tax strategies. https://advisors.vanguard.com/insights/article/IWE_ResPuttingAValueOnValue. 2. Based on 2023 T. Rowe Price Retirement Savings and Spending Study that showed individuals with a formal plan were over two to almost four times wealthier than pre-retirees without a plan. https://www.prnewswire.com/news-releases/two-thirds-of-americans-say-their-financial-planning-needs-improvement-301881539.html. 3. Based on a US Bureau of Labor Statistics 2023 American Time Use Survey that showed, among the top Americans who engage in financial planning themselves, they typically spend 59 minutes a day managing their money. https://www.bls.gov/news.release/pdf/atus.pdf

Featured in

Delighted Clients

These testimonials are from current clients of Domain Money Advisors, LLC (Domain). No compensation (non-cash or otherwise) was provided in exchange for these testimonials. Domain does not have any material conflict of interest with the persons giving these testimonials. Some of the testimonials may be shortened for length only and not to distort or improve the overall testimoniy. Profile images are for representational purposes only and do not depict actual client images. Testimonials were selected to highlight the diversity of our CERTIFIED FINANCIAL PLANNER® professionals and not based on client experience, investment performance, or any rating.

No AUM Fees – ever

Transparent, flat-fee pricing. And never any hidden costs or assets under management (AUM) fees.

Best-in-class security

Fully-encrypted data protected; 2-factor authentication.

CFP® professionals

Delivering unbiased, expert advice as a true fiduciary, acting in the best interests of the client.

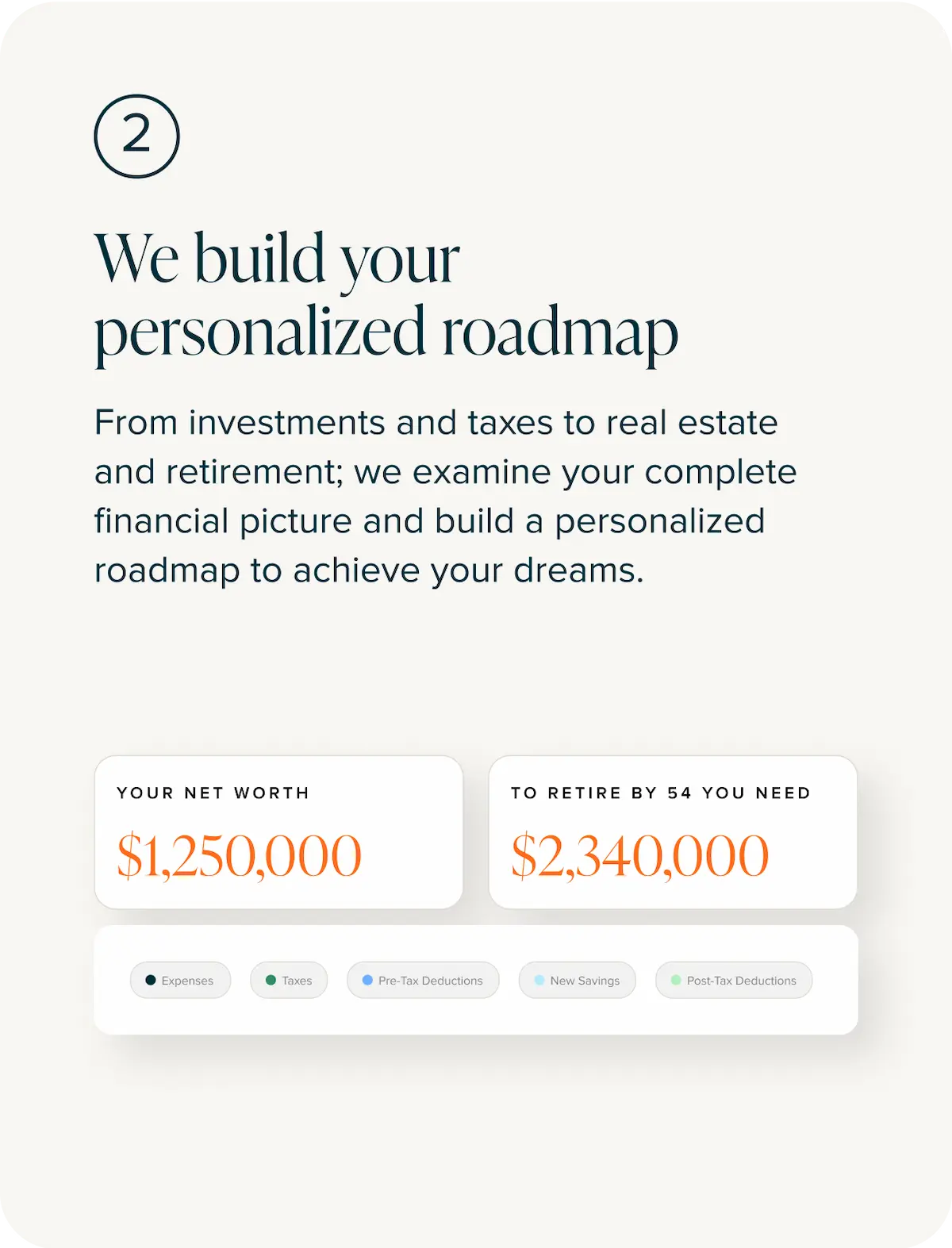

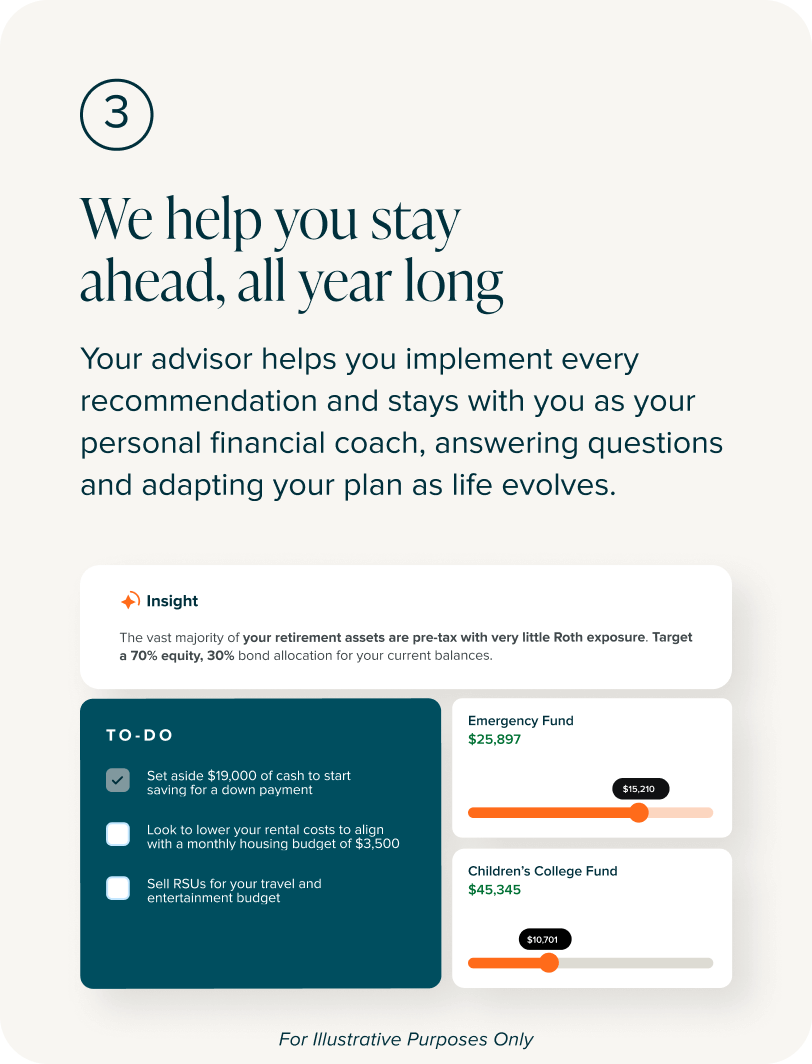

How we help you reach more goals – faster

Three simple steps to transform your financial future with expert guidance that evolves with your life.

For Illustrative Purposes Only

See how we work with youTraditional advisors often focus narrowly on investment management and charge a percentage of your portfolio (AUM). Domain Money takes a broader, coach-style approach. We build a personalized plan that covers your entire financial life—cash flow, taxes, equity compensation, real estate, retirement, and insurance. You’ll work with the same dedicated CFP® professional for ongoing guidance, with no product sales or commission incentives.

Instead of paying a percentage of your assets (which grows as your wealth grows), you pay one predictable annual membership fee. That fee covers your complete financial plan, regular updates, and unlimited access to your CFP® professional

Every Domain Money advisor is a CERTIFIED FINANCIAL PLANNER® professional. This means they’ve completed rigorous education, experience, and ethics requirements, and are trained to look at your full financial picture. Our advisors act as fiduciaries, which means they’re legally and ethically obligated to put your best interests first. You’ll have expert guidance from someone who knows you personally—not a rotating advisor or call center.

Yes. All Domain Money CFP® professionals are fiduciaries. That means we’re required to put your best interests ahead of our own at all times. Unlike advisors who earn commissions on products, we don’t sell financial products or take referral fees. Our only focus is giving you objective, conflict-free advice to help you make smarter money decisions with confidence.

Absolutely. Most clients work with us as a household, so both spouses (or family members) are included in the planning process. We’ll align your shared goals—like buying a home, funding college, or retiring early—while also addressing individual priorities. You’ll leave with one clear, step-by-step plan that helps your entire family move forward together.

Traditional advisors often charge around 1% of assets under management (AUM) each year. For example, a $1M portfolio could mean $10,000 annually in fees, on top of potential charges for trades, mutual funds, or wrap fees. Some also require investment minimums. At Domain Money, our model is different—you pay one transparent annual membership fee, no matter your portfolio size. That covers your entire financial plan, including tax strategies, real estate guidance, and retirement planning.